As an urban planner, I find myself at the intersection of a recent controversial issue: reclamation projects. The debate has been ignited by the suspension of reclamation projects by BBM, pending a review of its environmental compliance and impacts.

To put the urbanization landscape into perspective, let’s examine some key data points:

- The National Capital Region (NCR), occupying a mere 0.2% of the country’s total land area, is the most densely populated region, with an astonishing population density of 18,165.1 persons per square kilometer.

- Regions such as Central Luzon (Region III), and Southern Tagalog (Region IV), with urbanization rates ranging from 46.4% to 60.5%, experience significant urban growth.

- Surprisingly, the CALABARZON corridor, encompassing the urban areas of Cavite, Laguna, Batangas, Rizal, and Quezon, has surpassed even NCR in population size. With 12.61 million inhabitants, this urban corridor now outpaces both NCR and Central Luzon.

- The Philippines has 33 highly urbanized cities (HUCs), with all 16 NCR cities classified as such. Four of these HUCs, namely Caloocan City, the City of Manila, Quezon City (all within NCR), and Davao City in southern Mindanao, host over a million inhabitants.

- Conversely, regions like the Cordillera Administrative Region (CAR) and other regions in Visayas and Mindanao, stand as the least densely populated areas, posing unique urbanization challenges and opportunities.

The DENR Secretary’s recent statements have shed light on her nuanced perspective regarding reclamation projects. While her stance doesn’t outright oppose reclamation, it emphasizes the importance of considering the compounded risks associated with such endeavors. In her view, these compounded risks should play a pivotal role in cumulative impact assessments and resilience analytics, ensuring that the potential hazards are thoroughly factored in.

The Dark Side of Reclamation

In contrast, reclamation projects typically involve the filling of coastal or waterfront areas to create new urban land. While these projects offer space for development, they carry significant drawbacks. These include the disruption of vital coastal ecosystems, the displacement of communities, alterations in local hydrology, and environmental degradation.

These compounded risks encompass a spectrum of hazards, all of which need careful evaluation. Among them are the threats of liquefaction and tsunamis stemming from the movements in the Manila Trench, a geological phenomenon that requires vigilant attention. Additionally, the presence of fault systems, notably the West Valley Fault and others impacting the region adds complexity to the risk assessment process. Lastly, the Secretary underscores the impacts of climate change, including rising sea surface temperatures, sea-level rise, the projected increase in the intensity of tropical cyclones, extreme rainfall events, and the vulnerability to storm surges and flooding, as vital factors that must be considered.

Nevertheless, the Secretary acknowledges that reclamation projects can serve a beneficial purpose when executed judiciously. She points to international examples, such as Rotterdam in the Netherlands, where much of the city stands as a testament to the success of reclamation in creating resilient urban areas. Similarly, reclamation has been employed to create new land for transportation infrastructure and urban expansion in Boston, contributing to the city’s growth and development. These global instances demonstrate that reclamation, with careful planning and risk mitigation strategies, can be a valuable tool for urban development.

Compact Cities: A Blueprint for Sustainability

Alongside spreading regional development, compact cities offer a vision of urban planning that encapsulates the essence of sustainability. By concentrating urban growth within predefined boundaries, compact development champions the efficient utilization of precious urban land. Unlike urban sprawl, which indiscriminately expands cities into previously untouched areas, compact development safeguards natural landscapes, agricultural land, and green spaces on the urban fringes. These components are essential for biodiversity, ecosystem services, and overall environmental health.

A core objective of compact cities is to counteract urban sprawl—a common urban planning pitfall. Urban sprawl devours vast expanses of land, leading to longer commutes, increased infrastructure demand, and heightened environmental strain. Compact development resists this outward expansion, instead nurturing growth within existing urban confines. This not only conserves land but also fosters close-knit communities, promoting social interaction and a sense of belonging.

Further, spreading regional development represents a compelling and sustainable strategy. Rather than concentrating urban growth within a single metropolitan area, this approach advocates for the equitable distribution of economic activities and infrastructure across various regions. It capitalizes on the unique strengths and resources of each region, ultimately reducing disparities in economic development. Moreover, this approach preserves coastal ecosystems and green spaces, effectively mitigating environmental risks and fostering ecological sustainability. Avoiding over-dependence on a single urban center enhances community resilience and ensures a more equitable distribution of development benefits. Beyond its environmental and social merits, this strategy offers long-term political and economic stability by minimizing disproportionate impacts from natural disasters or economic downturns.

A Path Forward for Sustainable Development

In the grand scheme of urbanization, the choice between compact cities, spreading regional development, and reclamation projects is not merely an urban planner’s conundrum. It is a pivotal decision that will profoundly shape the future of our cities and communities. While reclamation projects may offer seemingly expedient solutions to land scarcity, they come with significant environmental and social burdens.

Compact development and spreading regional development, on the other hand, align with the principles of sustainability, resilience, and equitable growth. They envision a harmonious coexistence between urbanization and the natural world—a vision that not only serves the present but also secures a more sustainable future for generations to come.

Conclusion

Compact development and spreading regional development offer sustainable urban planning models that prioritize resource conservation, environmental sustainability, and an enhanced quality of life. These models emphasize efficient land use, reduced urban sprawl, and diversified transportation options. Reclamation projects, raise substantial environmental and social concerns. As we navigate the future of our cities and regions, embracing these sustainable models may hold the key to greener, more connected, and healthier urban environments and regional development.

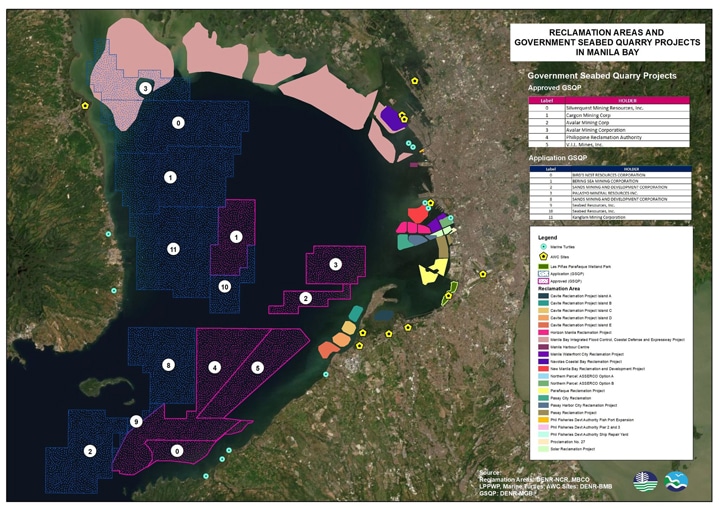

Map of Reclamation Projects in Manila Bay