Assessing the Complexities and Implications of Proposed Property Tax Reforms in Cebu City

Understanding Inverse Condemnation

If you own a property, it is essential to be aware of your rights when the government takes your land for public use. While eminent domain, the power of the government to take private property, is a well-known concept, its counterpart, inverse condemnation, often remains in the shadows. In this article, we will explore what inverse condemnation is, why it is vital for property owners, and how it plays out in a real-world case.

What is Inverse Condemnation?

Inverse condemnation is a legal doctrine that allows property owners to seek just compensation from the government when their property has effectively been taken, even if the government hasn’t formally initiated an expropriation or condemnation proceeding. This concept is a crucial safeguard to ensure property owners are not deprived of their rights when government actions or projects impact their land.

The Case of the Heirs of Macabangkit Sangkay: A Real-Life Example

In a notable case involving the Heirs of Macabangkit Sangkay and the National Power Corporation (NPC), the Supreme Court addressed the issue of just compensation in an inverse condemnation scenario. In this case:

- The NPC embarked on a project that involved the construction of a tunnel through a piece of land belonging to the Heirs of Macabangkit Sangkay.

- Importantly, NPC did not formally initiate an expropriation proceeding or seek the prior consent of the landowners.

- The Heirs of Macabangkit filed a complaint to seek compensation for effectively taking their property.

The Supreme Court ruled in favor of the Heirs of Macabangkit and affirmed the decision of the Regional Trial Court (RTC). The court held that the value used as the basis for compensation should be determined as of the time when the complaint was filed. In other words, the compensation would be calculated based on the property’s value at the time when the landowners initiated their legal action.

The Supreme Court justified this decision by emphasizing the principle of fairness. It noted that calculating compensation based on the market value at the time NPC entered the land or when the tunnel project was completed would be unjust. This is because it would compound the gross unfairness already caused to the landowners. NPC had entered the property without the intention of formally expropriating the land, and without obtaining the prior knowledge and consent of the Heirs of Macabangkit.

Why Inverse Condemnation Matters:

Inverse condemnation is crucial for several reasons:

- Protection of Property Rights: It ensures that property owners’ rights are upheld, even when the government takes their property without following formal expropriation procedures.

- Just Compensation: Property owners have the right to seek just compensation when their land is effectively taken, which is often enshrined in the constitution of many countries, including the Philippines.

- Legal Remedy: Inverse condemnation provides a legal remedy for property owners to address government actions that infringe upon their property rights.

- Real estate appraisers are essential in the determination of just compensation in cases of eminent domain and inverse condemnation. Their objective and unbiased appraisal expertise is crucial in safeguarding the property owner’s rights and interests in government-taking cases.

Inverse condemnation serves as a vital legal concept that protects property owners’ rights when their land is effectively taken by the government. Property owners should be aware of their rights and seek legal counsel and valuer when facing government takings to ensure their interests are protected and justice is served.

The Driving Forces Behind Reclamation Projects

Manila Bay Reclamation, part 2

As an urban planner deeply immersed in the intricacies of urban development, I find myself engaged in a profound contemplation of the complex issue of reclamation. In the first part of this discourse, we delved into the critical context of sustainability, contrasting the merits of compact urbanization and regionalization against the backdrop of extensive reclamation projects. Now, in the second part of this exploration, our gaze shifts toward a different facet of the reclamation conundrum: profitability. While sustainability concerns often take center stage in the discourse surrounding urban development, it is essential to acknowledge that the driving force behind many ambitious reclamation projects is the promise of substantial financial gain. In the following pages, we embark on a journey to unravel the intricate relationship between profitability and reclamation, dissecting the economic motivations that propel these colossal ventures, and considering the implications they hold for the urban landscapes they shape.

Reclamation projects involve the transformation of coastal or underwater areas into usable land, often with the goal of generating economic benefits for various stakeholders. Reclamation projects have emerged as pivotal drivers of urban development, promising substantial economic gains for proponents and joint venture partners. This paper delves into the multifaceted landscape of reclamation endeavors, revealing the driving forces behind them and their potential impacts on various stakeholders.

Reclamation projects in the Philippines are strategically concentrated in and around Metro Manila, the country’s economic and political hub. This geographic focus is not coincidental but a result of careful consideration of several factors. Metro Manila serves as the Philippines’ economic center, hosting a significant portion of the country’s businesses, industries, and commercial activities. It is home to corporate headquarters, financial institutions, government offices, and numerous job opportunities. This economic prominence continues to attract people from across the nation.

As provided by various literature, reclamation efforts in the Philippines can be traced back to the Spanish colonial era when the Spanish authorities initiated land reclamation projects in Manila Bay. These projects aimed to expand the city of Manila and create additional space for development and fortifications.

During the American colonial period, particularly in the early 20th century, reclamation projects continued in Manila Bay. The most notable of these projects was the construction of the Manila South Harbor. In the post-World War II period, reclamation activities in the Philippines gained momentum as the country experienced urbanization and population growth. Several reclamation projects were initiated along the Manila Bay coastline, including the development of the Cultural Center of the Philippines (CCP) Complex.

Metro Manila has witnessed rapid urbanization over the past few decades. As the population continues to grow, the demand for urban land has intensified. People from rural areas and other regions of the Philippines flock to the capital in search of better economic opportunities, which further accelerates urban expansion.

| Reclamation Project | Location | Proponent | Private JV Partner or Developer |

| Pasay SM Reclamation Project | Pasay City | City | SM Prime Holdings |

| Pasay Harbor City Reclamation Project | Pasay City | City | Pasay Harbour City |

| Manila Solar City | Manila | Consurtium (LGU & MGDC) | Consortium (LGU & MGDC) |

| Manila Waterfront City Reclamation | Manila City | City | Waterfront Manila Premier Development |

| Horizon Manila Reclamation Project | Manila City | City | Jbrce Construction Corporation |

| City of Pearl/New Manila Bay Reclamation Project | Manila City | City | UAA Kimming Group Development Corp |

| Navotas Coastal Bay Reclamation and Development Project | Navotas City | City | Argonbay Construction Company |

| Las Pinas-Paranaque Coastal Bay Project | Las Pinas, Paranaque City | City | Alltech Construction Inc. |

| Bacoor Reclamation and Development Project | Bacoor City | City | Frabelle Fishing Corp |

| Bacoor Reclamation and Development Project (outer island project) | Bacoor City | City | Frabelle Fishing Corp |

| Diamond Reclamation and Development Project | Bacoor City | City | Frabelle Fishing Corp |

| MCTE Manila Bay Reclamation Project | Bacoor Province | Province | Coastal Road Corp |

| Cavite 4-island Reclamation Project | Cavite City | Province | Century Peak Corp |

The involvement of city governments as proponents of these reclamation projects signifies their commitment to urban development and economic growth. Cities in the Philippines, especially those in densely populated areas like Metro Manila, face significant challenges related to land scarcity and infrastructure demands. Reclamation projects offer an opportunity for these cities to expand their territory, create new land for development, and address these challenges. However, it’s important for city governments to balance economic interests with environmental and social considerations, ensuring that the benefits of such projects are distributed equitably and sustainably within their communities.

The use of a consortium involving both the local government unit (LGU) and Manila Goldcoast Development Corp (MGDC) as proponents indicates a collaborative approach to reclamation. This partnership allows for the pooling of resources, expertise, and responsibilities. The LGU likely provides regulatory approvals, legal framework, and oversight, while MGDC brings financial resources and development expertise. Such partnerships can be effective in addressing complex development challenges, but they require clear agreements and cooperation between the public and private sectors to ensure transparency and accountability. The proponents of reclamation projects, whether city governments, consortia, or provinces, play a pivotal role in shaping the trajectory of urban development. Their decisions impact land use, economic growth, infrastructure development, and the overall well-being of their communities. It’s essential for these proponents to strike a balance between the economic benefits of reclamation and the need for sustainable, equitable, and environmentally responsible development. Public transparency, community engagement, and adherence to regulatory guidelines are crucial aspects of responsible reclamation project management.

Reclamation projects in Manila Bay exhibit considerable variation in terms of size and estimated costs, underlining the flexibility of reclamation as a strategy to address urban expansion challenges. From the expansive 844-hectare MCTE Manila Bay Reclamation Project to the more modest 90-hectare Bacoor Reclamation and Development Project, these endeavors offer diverse solutions to the ongoing land scarcity issues, particularly prominent in densely populated areas like Metro Manila.

The estimated project costs attached to these initiatives highlight their significant economic implications. These substantial investments indicate the potential to stimulate economic growth within the region, creating employment opportunities and fostering local economic development. However, the variation in project objectives is noteworthy, ranging from the development of prime urban real estate to the enhancement of infrastructure and public spaces. It also indicates a profitable undertaking and huge revenue generation for the government, both local and national.

| Reclamation Project | Size (Hectares) | Estimated Project Cost (PHP) |

| Pasay SM Reclamation Project | 390 | 81,248,000,000 |

| Pasay Harbor City Reclamation Project | 265 | 62,379,000,000 |

| Manila Solar City | 146 | 23,000,000,000 |

| Manila Waterfront City Reclamation | 318 | 37,191,000,000 |

| Horizon Manila Reclamation Project | 419 | 56,000,000,000 |

| City of Pearl/New Manila Bay Reclamation Project | 400.7 | 43,700,000,000 |

| Navotas Coastal Bay Reclamation and Development | 650 | 27,300,000,000 |

| Project | ||

| Las Pinas-Paranaque Coastal Bay Project | 635.14 | 26,153,000,000 |

| Bacoor Reclamation and Development Project (inner island project) | 90 | 2,869,000,000 |

| Bacoor Reclamation and Development Project (outer island project) | 230 | 10,934,000,000 |

| Diamond Reclamation and Development Project | 100 | 6,235,000,000 |

| MCTE Manila Bay Reclamation Project | 844 | – |

| Cavite 4-island Reclamation Project | 472 | 40,749,000,000 |

Real Estate Development Profits

Reclamation projects open up prime urban real estate opportunities. Take, for instance, the Pasay SM Reclamation Project, sprawling over 390 hectares with an estimated project cost of PHP 81.25 billion. This translates to an astonishing PHP 20,832.82 per square meter. This figure underscores the immense profit potential awaiting developers who can convert reclaimed land into valuable properties.

Reclaimed areas often undergo swift property value appreciation. Within just a few years of development, property values can surge by 20% to 50% or even more. This exponential growth benefits not only developers but also bolsters local tax revenues, contributing to the financial well-being of municipalities.

Also, reclamation projects unlock diverse revenue streams. Land sales, property leasing, development permits, and licensing fees become significant contributors to project revenues. For example, the Pasay Harbor City Reclamation Project, spanning 265 hectares with an estimated cost of PHP 62.38 billion, underscores the financial promise with a staggering PHP 23,539.25 per square meter.

The scale of reclamation projects necessitates massive infrastructure development. Roads, utilities, and public amenities demand substantial investments, leading to multimillion-dollar contracts for construction companies. These contracts not only enhance infrastructure but also stimulate economic activity within the region.

Comparing Reclamation Project Costs to Median Land Prices

However, as an urban planner and real estate consultant, I compared the estimated project costs of reclamation projects to the median land prices in various cities in Metro Manila, based on 2021 average price data derived from dotproperty.com:

- Pasay SM Reclamation Project: Estimated at PHP 81.25 billion for 390 hectares, this project significantly exceeds the median land price in Pasay at PHP 293,480,000 per square meter, highlighting the vast potential for property value per square meter in the reclaimed area.

- Las Piñas-Paranaque Coastal Bay Project: Covering 635.14 hectares with an estimated cost of PHP 26.15 billion, this project’s potential property value per square meter surpasses the median land prices in Las Piñas and Paranaque at PHP 25,000,000 and PHP 28,912,000, respectively, by a substantial margin.

- Manila Waterfront City Reclamation. With an estimated project cost of PHP 37.19 billion for 318 hectares, this project’s potential property value per square meter outpaces the median land price in Manila at PHP 53,000,000.

| Location | Median List Price Per Sq.m. (₱) |

| Cavite City | 25,634 |

| Bacoor | 45,465 |

| Bulacan | 12,924 |

| Manila | 118,195 |

| Pasay City | 92,689 |

| Bataan | 18,400 |

| Batangas | 13,239 |

| Pampanga | 26,979 |

These comparisons underscore the significant profit potential of reclamation projects, as property values in reclaimed areas can far exceed median land prices in established cities. However, it’s crucial to bear in mind that these are estimates, and actual property values may fluctuate based on market dynamics and the success of development.

While profit potential often serves as a primary driver for interest in reclamation projects, it’s essential to approach them with a balanced perspective. They present economic benefits and development opportunities, but they also pose environmental, social, and infrastructure challenges. Striking a harmonious balance between economic gains, environmental sustainability, and community well-being is fundamental for responsible and ethical urban development. Public transparency and comprehensive assessments are vital to ensure that reclamation projects align with broader urban planning goals and prioritize the welfare

Property Value Appreciation

One of the most significant economic benefits of reclamation projects is property value appreciation. This phenomenon refers to the increase in the market value of real estate properties located in the reclaimed area over time. It occurs as a result of various factors, with developers’ investments in infrastructure and amenities being a significant catalyst.

Reclamation projects necessitate substantial investments in infrastructure and amenities to make the newly created land suitable for development and attractive to potential buyers or tenants. These investments may include the construction of roads, bridges, utilities (water, electricity, sewage), parks, recreational facilities, and more.

Property value appreciation benefits developers directly by increasing the market value of the properties they own or have developed. They can command higher prices for their properties, leading to greater profits when selling or leasing.

Increased property values contribute to higher property tax revenues for local governments. This additional revenue can be reinvested in public services and infrastructure, benefiting the community.

Property value appreciation is often a long-term trend. While there may be initial spikes in value as infrastructure is developed, sustained appreciation can continue for years or even decades as the area matures and becomes an established part of the city.

It’s important to note that property value appreciation can sometimes lead to gentrification, where rising property values displace lower-income residents. Balancing the benefits of property value appreciation with the need for affordable housing and equitable development is a critical consideration for reclamation projects.

Government Collaboration

Collaboration with local governments can unlock financial benefits, such as infrastructure funding and tax incentives. In the case of the Manila Waterfront City Reclamation, a project covering 318 hectares with an estimated cost of PHP 37.19 billion, such collaboration can be financially significant.

In 2015 alone, Pasay City collected approximately Php 3.2 Billion in real property taxes, business permits, and work permits from the existing MOA reclamation area. With the larger proposed project, these financial gains will increase substantially.

These comparisons highlight the significant profit potential that reclamation projects offer to developers and joint venture partners. The property values in reclaimed areas can far surpass the median land prices in established cities, making reclamation a lucrative investment. However, it’s important to note that these are estimates, and actual property values may vary based on market dynamics and the success of the development.

The potential for substantial profits is indeed one of the factors that often drive interest in reclamation projects. Developers and joint venture partners are attracted to reclamation due to the opportunity to create prime real estate in desirable coastal locations, which can command high property values. This profit potential can be a significant driving force behind such projects.

However, it’s crucial to approach reclamation projects with a balanced perspective. While they can bring economic benefits and opportunities for property development, they also come with environmental, social, and infrastructure challenges. Balancing economic gains with environmental sustainability and the well-being of affected communities is essential for responsible and ethical urban development.

City of Pearl/New Manila Bay Reclamation Project

This project, located in Manila City, covers 400 hectares. Its estimated project cost per square meter is PHP 10,905.91. This relatively low project cost per square meter presents an attractive opportunity for developers.

Developers involved in this project can acquire the reclaimed land at this cost, invest in infrastructure development, and create valuable properties. Once developed, they have the potential to sell or lease these properties at a significantly higher price per square meter. This price difference between the project cost and the selling or leasing price per square meter is where developers stand to make substantial profits.

Comparing the project cost per square meter (PHP 10,905.91) with the median list price per square meter in Manila (PHP 118,195), it becomes evident that developers can potentially realize substantial returns on their investment. The difference in price per square meter highlights the profit potential of reclamation projects like the City of Pearl/New Manila Bay Reclamation Project.

Further, as with other reclamation projects, the City of Pearl/New Manila Bay Reclamation Project is likely to experience rapid property value appreciation. Developers’ investments in infrastructure, amenities, and urban development in the reclaimed area can drive property values up significantly. This appreciation benefits not only developers but also contributes to increased local property tax revenues.

The property value appreciation in these reclaimed areas can result in property values that far surpass the median land prices in established cities, further underlining the attractiveness of reclamation projects as lucrative investments for developers.

Thus, reclamation projects, such as the City of Pearl/New Manila Bay Reclamation Project, provide developers with opportunities to acquire land at relatively lower costs, develop it into valuable properties, and profit by selling or leasing these properties at significantly higher prices per square meter. Property value appreciation in these areas further enhances the economic benefits, making reclamation projects appealing for developers seeking substantial returns on their investments.

In the grand tapestry of urban development, the issue of reclamation remains a multifaceted enigma, intertwining sustainability, economic prosperity, and the intricate dance of public and private interests. As urban planners and stewards of our cities, we find ourselves in a delicate balancing act. While the pursuit of profitability can be undeniable, it is our duty to ensure that the chords of sustainability and equitable progress resonate harmoniously in the urban symphony. The journey ahead may be fraught with challenges, but it is through thoughtful planning, unwavering commitment to the welfare of our communities, and a vision that extends far beyond the horizon that we can aspire to create cities that flourish in every sense—cities where prosperity thrives, but not at the expense of our shared home.

Sustainable Advantages of Compact Cities Over Reclamation Projects: An Urban Planner’s Perspective

As an urban planner, I find myself at the intersection of a recent controversial issue: reclamation projects. The debate has been ignited by the suspension of reclamation projects by BBM, pending a review of its environmental compliance and impacts.

To put the urbanization landscape into perspective, let’s examine some key data points:

- The National Capital Region (NCR), occupying a mere 0.2% of the country’s total land area, is the most densely populated region, with an astonishing population density of 18,165.1 persons per square kilometer.

- Regions such as Central Luzon (Region III), and Southern Tagalog (Region IV), with urbanization rates ranging from 46.4% to 60.5%, experience significant urban growth.

- Surprisingly, the CALABARZON corridor, encompassing the urban areas of Cavite, Laguna, Batangas, Rizal, and Quezon, has surpassed even NCR in population size. With 12.61 million inhabitants, this urban corridor now outpaces both NCR and Central Luzon.

- The Philippines has 33 highly urbanized cities (HUCs), with all 16 NCR cities classified as such. Four of these HUCs, namely Caloocan City, the City of Manila, Quezon City (all within NCR), and Davao City in southern Mindanao, host over a million inhabitants.

- Conversely, regions like the Cordillera Administrative Region (CAR) and other regions in Visayas and Mindanao, stand as the least densely populated areas, posing unique urbanization challenges and opportunities.

The DENR Secretary’s recent statements have shed light on her nuanced perspective regarding reclamation projects. While her stance doesn’t outright oppose reclamation, it emphasizes the importance of considering the compounded risks associated with such endeavors. In her view, these compounded risks should play a pivotal role in cumulative impact assessments and resilience analytics, ensuring that the potential hazards are thoroughly factored in.

The Dark Side of Reclamation

In contrast, reclamation projects typically involve the filling of coastal or waterfront areas to create new urban land. While these projects offer space for development, they carry significant drawbacks. These include the disruption of vital coastal ecosystems, the displacement of communities, alterations in local hydrology, and environmental degradation.

These compounded risks encompass a spectrum of hazards, all of which need careful evaluation. Among them are the threats of liquefaction and tsunamis stemming from the movements in the Manila Trench, a geological phenomenon that requires vigilant attention. Additionally, the presence of fault systems, notably the West Valley Fault and others impacting the region adds complexity to the risk assessment process. Lastly, the Secretary underscores the impacts of climate change, including rising sea surface temperatures, sea-level rise, the projected increase in the intensity of tropical cyclones, extreme rainfall events, and the vulnerability to storm surges and flooding, as vital factors that must be considered.

Nevertheless, the Secretary acknowledges that reclamation projects can serve a beneficial purpose when executed judiciously. She points to international examples, such as Rotterdam in the Netherlands, where much of the city stands as a testament to the success of reclamation in creating resilient urban areas. Similarly, reclamation has been employed to create new land for transportation infrastructure and urban expansion in Boston, contributing to the city’s growth and development. These global instances demonstrate that reclamation, with careful planning and risk mitigation strategies, can be a valuable tool for urban development.

Compact Cities: A Blueprint for Sustainability

Alongside spreading regional development, compact cities offer a vision of urban planning that encapsulates the essence of sustainability. By concentrating urban growth within predefined boundaries, compact development champions the efficient utilization of precious urban land. Unlike urban sprawl, which indiscriminately expands cities into previously untouched areas, compact development safeguards natural landscapes, agricultural land, and green spaces on the urban fringes. These components are essential for biodiversity, ecosystem services, and overall environmental health.

A core objective of compact cities is to counteract urban sprawl—a common urban planning pitfall. Urban sprawl devours vast expanses of land, leading to longer commutes, increased infrastructure demand, and heightened environmental strain. Compact development resists this outward expansion, instead nurturing growth within existing urban confines. This not only conserves land but also fosters close-knit communities, promoting social interaction and a sense of belonging.

Further, spreading regional development represents a compelling and sustainable strategy. Rather than concentrating urban growth within a single metropolitan area, this approach advocates for the equitable distribution of economic activities and infrastructure across various regions. It capitalizes on the unique strengths and resources of each region, ultimately reducing disparities in economic development. Moreover, this approach preserves coastal ecosystems and green spaces, effectively mitigating environmental risks and fostering ecological sustainability. Avoiding over-dependence on a single urban center enhances community resilience and ensures a more equitable distribution of development benefits. Beyond its environmental and social merits, this strategy offers long-term political and economic stability by minimizing disproportionate impacts from natural disasters or economic downturns.

A Path Forward for Sustainable Development

In the grand scheme of urbanization, the choice between compact cities, spreading regional development, and reclamation projects is not merely an urban planner’s conundrum. It is a pivotal decision that will profoundly shape the future of our cities and communities. While reclamation projects may offer seemingly expedient solutions to land scarcity, they come with significant environmental and social burdens.

Compact development and spreading regional development, on the other hand, align with the principles of sustainability, resilience, and equitable growth. They envision a harmonious coexistence between urbanization and the natural world—a vision that not only serves the present but also secures a more sustainable future for generations to come.

Conclusion

Compact development and spreading regional development offer sustainable urban planning models that prioritize resource conservation, environmental sustainability, and an enhanced quality of life. These models emphasize efficient land use, reduced urban sprawl, and diversified transportation options. Reclamation projects, raise substantial environmental and social concerns. As we navigate the future of our cities and regions, embracing these sustainable models may hold the key to greener, more connected, and healthier urban environments and regional development.

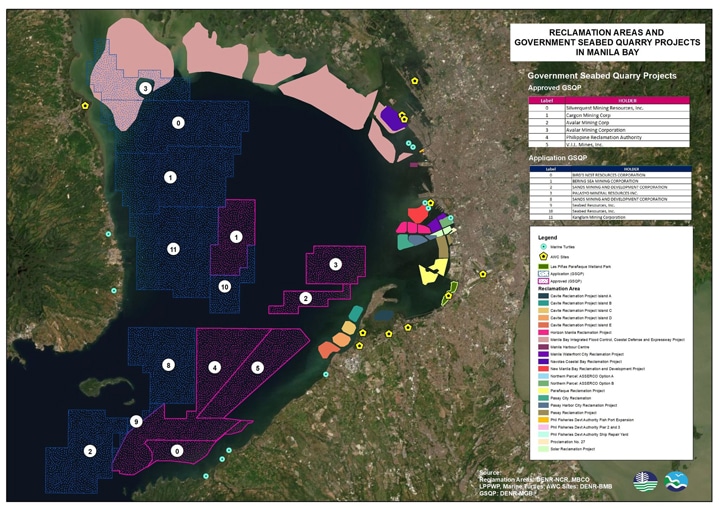

Map of Reclamation Projects in Manila Bay

Image of Manila Landscape

Power of Proactive Real Estate Investment

Just as in any other industry, the principle “prevention is better than cure” holds true in real estate investment. Engaging in real estate investment without thorough preparation can lead to significant financial setbacks and challenges. It is imperative for investors to conduct comprehensive due diligence and feasibility studies before committing their capital.

Let us discuss further of this crucial concept.

Due Diligence in Real estate investments involves substantial capital, and they often have long-term implications. Conducting due diligence means thoroughly researching and evaluating every aspect of the property or project under consideration. This process involves reviewing legal documents, inspecting the physical condition of the property, examining market trends, and assessing the financial viability. By doing this, investors can identify any potential issues or risks that might affect their investment. This preventive step allows them to make informed decisions and avoid costly surprises down the road.

Feasibility studies are a fundamental part of real estate investment. They involve a systematic analysis of various factors, including market demand, construction costs, financing options, and potential returns on investment. These studies provide valuable insights into whether a particular project is financially viable and if it aligns with the investor’s objectives. A well-conducted feasibility study can reveal whether the investment is likely to generate the expected returns or if there are hidden risks that need to be addressed.

Real estate investments come with inherent risks, such as market fluctuations, property depreciation, or unexpected expenses. Through due diligence and feasibility studies, investors can identify these risks and implement strategies to mitigate them. For example, they might consider diversifying their real estate portfolio, purchasing insurance, or setting aside contingency funds for unforeseen expenses. Proactive risk management is a form of preventive action that can safeguard the investor’s capital and long-term financial stability.

Understanding the current and future market conditions is critical in real estate. Market research allows investors to anticipate trends, assess demand for certain types of properties, and make decisions that align with market dynamics. Without this preventive measure, investors might invest in properties that become less desirable or experience a decline in value due to changing market conditions.

Real estate investments involve complex legal frameworks, including property laws, zoning regulations, and tax codes. Failing to comply with these laws can result in legal disputes, fines, or even property seizures. Investors must proactively ensure that their investments adhere to all legal requirements, which is a preventive measure against costly legal issues.

In sum, real estate investment demands a proactive approach that prioritizes prevention over cure. By conducting due diligence, feasibility studies, risk mitigation, market research, and legal compliance, investors can reduce the likelihood of encountering unexpected challenges or losses in their real estate ventures. This prudent approach not only safeguards their investments but also enhances the potential for long-term financial success in the dynamic world of real estate.

Why do appraisers charge upfront fees on Expropriation Cases?

In the field of legal battles, expropriation cases stand out as a unique arena where various professionals come together to ensure justice is served. Lawyers play a pivotal role in advocating for their clients, but there’s another crucial player in this complex process – the appraiser. Their role, although less often in the spotlight, is equally significant in achieving a fair and just resolution. Recently, a lawyer raised an important question: Why do appraisers charge upfront fees when lawyers typically work on a contingent basis?

The answer lies in the very nature of the appraiser’s role and the need to maintain objectivity in the assessment of just compensation.

Independence and Unbiased Approach

Appraisers are tasked with evaluating the value of property subject to expropriation. Unlike lawyers, their role is not fiduciary in nature. This means that appraisers are expected to provide an impartial and unbiased assessment of the property’s value. Their professional integrity rests on their ability to deliver accurate valuations free from any external influence.

Avoiding Bias in Decision-Making

Imagine if appraisers were compensated on a contingent basis, meaning their fees depended on the outcome of the case. In such a scenario, their primary focus might shift from providing an objective valuation to ensuring that their client wins the case. This shift in motivation could introduce a troubling bias into their work. Instead of aiming for an accurate valuation, appraisers might be tempted to sway their assessments to align with their client’s interests.

Distinct Roles in Expropriation Cases

Expropriation cases involve a collaborative effort between lawyers and appraisers, each with a distinct role to play. Lawyers are responsible for legal advocacy and representation, fighting for their client’s rights within the boundaries of the law. Appraisers, on the other hand, provide a critical service by offering an unbiased and accurate appraisal of the property’s value. This appraisal serves as the foundation upon which the legal argument is built.

Professional Integrity

By billing clients upfront and avoiding contingent fees, appraisers uphold the integrity of their profession. Their fee structure ensures that appraisals are conducted according to professional standards rather than being influenced by the desire for a specific legal outcome. This unwavering commitment to objectivity ensures that all parties involved can trust in the fairness of the process.

In conclusion, the role of appraisers in expropriation cases is one of objectivity and professionalism. They provide an essential service by independently assessing property values without being swayed by the legal battle’s outcome. Upholding their commitment to integrity, appraisers charge upfront fees to maintain the impartiality that is so crucial in these cases. In doing so, they contribute significantly to achieving a fair and just resolution for all parties involved.

SOLVE Inducts Officers and Members at Imus Regional Trial Court

Imus City, July 18, 2023: The Society of Litigation Valuation Experts (SOLVE) marked a historic milestone as it successfully held its induction of officers and members at Imus Regional Trial Court. Attended by esteemed professionals from various regions, legal professions, and academia, the ceremony celebrated the formation of the pioneering organization and recognized the dedication and expertise of its members, signifying a significant leap forward in the field of litigation valuation in the Philippines.

Led by Gus Agosto, President of SOLVE and a respected figure in the litigation valuation community and one of the founding members, SOLVE’s induction ceremony showcased a united vision of elevating the practice of litigation appraisal. With the surge in “Build, Build, Build” projects and the ensuing rise in expropriation cases, the Supreme Court designated special courts to address these matters, with Imus Regional Trial Court playing a pivotal role in ensuring fair and just compensation.

The venue’s selection at Imus Regional Trial Court underscored SOLVE’s commitment to staying at the forefront of the appraisal profession, particularly in the context of expropriation cases. It emphasized the organization’s recognition of the significance of accurate, impartial, and defensible appraisals in protecting property rights and ensuring justice for affected parties.

During the induction, the newly appointed officers, representing various regions and professions, pledged to uphold the highest standards of excellence, ethics, and collaboration in the field of litigation appraisal. President Gus Agosto emphasized their collective responsibility to shape the future of the profession and drive positive change.

SOLVE’s membership comprised seasoned professionals and emerging experts, each contributing their passion and expertise to the organization’s mission. PRBRES Board Member Arne Tan, in a virtual message, emphasized the organization’s pioneering role in the field and highlighted the importance of shaping its future.

The successful induction ceremony concluded with a sense of excitement and anticipation for SOLVE’s future. The organization’s commitment to excellence, collaboration, and professional growth resonated throughout the venue, signifying its dedication to shaping a brighter future for litigation valuation in the Philippines.

As SOLVE embarks on its transformative journey, the appraisal community eagerly awaits the positive impact it will make in the legal landscape and the lives of those seeking fair and accurate valuations in the realm of litigation.

About SOLVE: SOLVE is the first-of-its-kind organization in the Philippines, dedicated to the expertise of litigation valuation. Comprising esteemed professionals from various regions, the organization aims to advance the field of litigation appraisal, foster camaraderie among experts, and serve as a guiding light in the complex landscape of valuation legal disputes. With a commitment to upholding the highest standards of professionalism and integrity, SOLVE seeks to make a lasting impact on the appraisal profession and promote justice in the country’s legal system.

Real Estate Damage Valuation

Recently, numerous clients requested for appraisal of the damage caused by Typhoon Yolanda and a government infrastructure project. In the wake of natural disasters or government infrastructure projects, property owners often face the daunting task of determining the extent of damages and securing fair compensation. A specialized appraisal method known as the Diminution in Value Appraisal proves to be an invaluable tool in accurately assessing property losses caused by events like Typhoon Yolanda and government-driven developments. Let’s delve into the significance of the DIV Appraisal method and how it aids property owners in their quest for just compensation.

Unlike traditional market value assessments, the DIV Appraisal method hones in on the specific damages or impairments suffered by a property due to a particular event or project. Whether it’s the devastating impact of Typhoon Yolanda or the restriction of access caused by government infrastructure projects, the DIV Appraisal offers a comprehensive evaluation of the economic losses faced by property owners.

The aftermath of Typhoon Yolanda left numerous properties in ruins, necessitating a precise assessment to determine the extent of damages. In such scenarios, the DIV Appraisal method proves to be invaluable. This specialized appraisal approach focuses on assessing the specific damages or impairments suffered by a property due to a particular event or project.

The DIV Appraisal process begins by evaluating the property’s value before the event, assuming it was in perfect condition with no damages or impairments (Unimpaired Market Value). The appraiser then takes into account the economic impact of the event, considering factors such as structural damage, loss of utility, and reduced marketability (Impaired Market Value).

By subtracting the Unimpaired Market Value from the Impaired Market Value, the appraiser arrives at the Damage Value. This value represents the specific economic loss suffered by the property due to Typhoon Yolanda, providing property owners with a clear understanding of the extent of the damages.

To obtain a credible DIV Appraisal, property owners must effectively communicate the loss in both legal and appraisal terms. Providing a current survey detailing the property’s condition before and after the event or infrastructure development is vital. The survey should highlight the extent of damages and the specific rights lost, assisting the appraiser in accurately assessing the diminution in value.

The DIV Appraisal method emerges as a powerful tool for property owners in the Philippines to assess damages and determine the true value of their properties after natural disasters or government infrastructure projects. Engaging competent appraisers well-versed in local real estate laws and regulations is essential for obtaining a credible DIV Appraisal. Armed with a comprehensive understanding of their property’s true value, property owners can seek just compensation for their losses and move forward with confidence.

Litigation Appraisers Elect First President

In a significant milestone for the field of litigation appraisal, Gus Agosto, a prominent real estate appraiser, has been elected as the first president of the Society of Litigation Valuation Experts (SOLVE). The elections took place yesterday, marking a momentous occasion for the newly formed organization dedicated to serving litigation appraisers across the country.

The announcement was made following the election of other key members of the organization’s leadership team. Atty. Henry Onia (Pangasinan) will serve as the Chairman, Arturo Lawa (General Santos City) as the Vice President, Eden Dayrit (Makati City) as the Secretary, and Roxanne Raguini (Bataan) as the Treasurer, Atty. Rhenier Mora (Cebu) as the Auditor, and Gerald Villareal (Cavite) as the PRO. Additionally, Ana Grace Briton (Lucena), Arnold Ambat Jr.(Davao), Reggie Cosalan (Baguio City), and Shim Suan (Cagayan de Oro) were elected as members of the Board of Trustees.

Gus Agosto, known for his expertise as a litigation appraiser and the President/CEO of AA+ Appraisal and Consultancy, will now take on the vital role of coordinating the national organization’s activities. With his vast experience and commitment to the profession, Agosto is poised to lead the organization in its mission to advance the field of litigation appraisal.

The Society of Litigation Valuation Experts (SOLVE) is the first professional specialty appraisal organization of its kind, comprising members from all corners of the nation. This new organization brings together a collective of dedicated professionals who are passionate about elevating the standards of litigation appraisal.

In a statement released by the newly formed organization, it was revealed that their shared vision and purpose are centered on several key objectives. These include:

- Establishing and Promoting Professional Standards: SOLVE aims to set high professional standards in the field of litigation appraisal, ensuring that all members adhere to ethical practices and maintain the utmost integrity in their work.

- Providing Exceptional Education and Training: The organization is committed to offering top-notch educational and training opportunities to its members, fostering continuous learning and growth within the profession.

- Fostering Networking and Collaboration: SOLVE recognizes the power of collaboration and aims to provide a platform for litigation appraisers to connect, exchange ideas, and learn from one another.

- Advocating for the Interests of Litigation Appraisers: The organization will actively represent and advocate for the interests of its members, seeking to create a supportive and conducive environment for their professional development.

- Ensuring Quality Assurance: SOLVE places a strong emphasis on maintaining the highest levels of quality assurance in the industry, ensuring that clients receive superior appraisal services.

The newly elected president, Gus Agosto, expressed his enthusiasm for the organization’s mission and invited all professionals in the field of litigation appraisal to join them on this exciting journey. With a commitment to excellence and innovation, SOLVE aims to shape the future of litigation appraisal, further enhancing the expertise and professionalism of its members to better serve their clients.

As the Society of Litigation Valuation Experts (SOLVE) embarks on this transformative endeavor, it signals a new era for the profession, promising to revolutionize the landscape of litigation appraisal and deliver unparalleled value to all stakeholders involved.